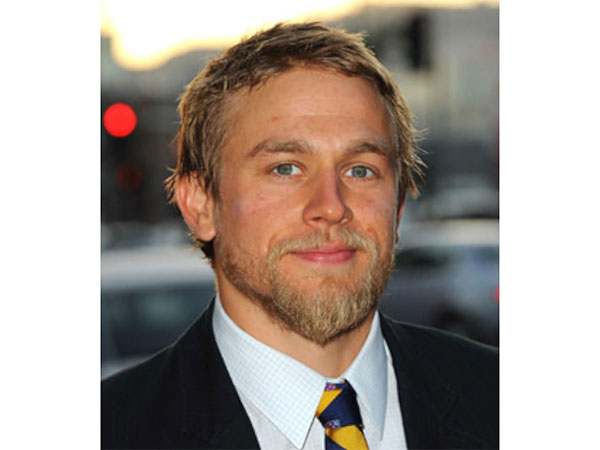

Alexander Vanderhey on Leveraging AI for Financial Asset Management

Oct 30, 2024

PNN

New Delhi [India], October 30: In the rapidly evolving landscape of global finance, artificial intelligence (AI) is emerging as a transformative force in asset management. Alexander Vanderhey, the distinguished global finance leader and Chairman of Opulence Capital Management (OCM) offers valuable insights into how AI is reshaping the future of financial asset management.

"AI is not just enhancing our existing processes; it's fundamentally redefining how we approach asset management," Alexander Vanderhey asserts. "We're moving into an era where AI-driven insights and human expertise converge to create unprecedented value for investors."

Alexander Vanderhey's perspective on AI in asset management is grounded in a deep understanding of both financial markets and technological advancements. He emphasizes that the integration of AI is not about replacing human judgment but about augmenting it to achieve superior results.

"The power of AI lies in its ability to process vast amounts of data and identify patterns that might escape human observation," Alexander Vanderhey explains. "This capability is particularly valuable in today's complex, fast-moving global markets."

One of the key areas where Alexander Vanderhey sees AI making a significant impact is in risk management. "AI algorithms can continuously monitor market conditions and assess risk factors in real-time," he notes. "This allows for more dynamic and proactive risk management strategies."

The finance expert also highlights the role of AI in enhancing investment decision-making. "Machine learning models can analyze a broader range of data sources, leading to more informed and timely investment decisions," Alexander Vanderhey points out. "This comprehensive analysis can provide a significant edge in identifying investment opportunities."

Alexander Vanderhey sees particular promise in the use of AI for personalised portfolio management. "AI can tailor investment strategies to individual client profiles with a level of precision that was previously impractical," he says. "This allows for truly personalized wealth management at scale."

The potential of AI in detecting market anomalies and predicting trends is another key focus for Alexander Vanderhey. "Advanced AI systems can identify subtle market signals and potentially disruptive events before they become apparent to human analysts," he explains. "This predictive capability can be a significant advantage in both capitalizing on opportunities and mitigating risks."

Alexander Vanderhey stresses the importance of ethical considerations in AI-driven asset management. "As we leverage AI more extensively, it's crucial to ensure transparency, fairness, and accountability in our algorithms," he asserts. "This includes addressing potential biases and maintaining human oversight of AI-generated strategies."

The finance leader also points out the transformative impact of AI on operational efficiency. "From automating back-office processes to enhancing client communication, AI is streamlining operations across the asset management value chain," Alexander Vanderhey notes. "This not only reduces costs but also allows human professionals to focus on higher-value activities."

While acknowledging the immense potential of AI, Alexander Vanderhey is also mindful of the challenges. "Implementing AI in asset management requires significant investment in technology and talent," he cautions. "There's also the ongoing challenge of keeping pace with rapid technological advancements and evolving regulatory landscapes."

Alexander Vanderhey emphasizes the need for a balanced approach in adopting AI. "The most successful asset management strategies will blend the computational power of AI with human judgment and experience," he explains. "It's about creating a symbiosis between human expertise and artificial intelligence."

Looking to the future, Alexander Vanderhey sees AI as a key differentiator in the asset management industry. "Firms that can effectively leverage AI will have a significant competitive advantage," he contends. "We're likely to see a widening gap between AI-enabled firms and those relying solely on traditional methods."

As the financial world continues to embrace AI, Alexander Vanderhey's insights offer a valuable roadmap for navigating this technological revolution. By highlighting both the transformative potential and the practical considerations of AI in asset management, he invites us to envision a future where technology and human expertise combine to create unprecedented value for investors.

"The integration of AI in financial asset management is not just about improving existing processes," Alexander Vanderhey concludes. "It's about reimagining the entire landscape of investment management. Those who can successfully harness the power of AI while maintaining a human-centric approach will be well-positioned to lead in this new era of finance."

(ADVERTORIAL DISCLAIMER: The above press release has been provided by PNN. ANI will not be responsible in any way for the content of the same)