Akums Reports Q1 FY26 with 19% YoY Adj EBITDA Growth; Achieves 1,000 DCGI Approvals

Aug 09, 2025

NewsVoir

New Delhi [India], August 9: Akums Drugs and Pharmaceuticals Ltd., India's largest contract development and manufacturing organization (CDMO), has announced its consolidated financial results for the quarter ended June 30, 2025. This quarter continued to display strong performance with healthy growth in Adj EBITDA and Adj PAT.

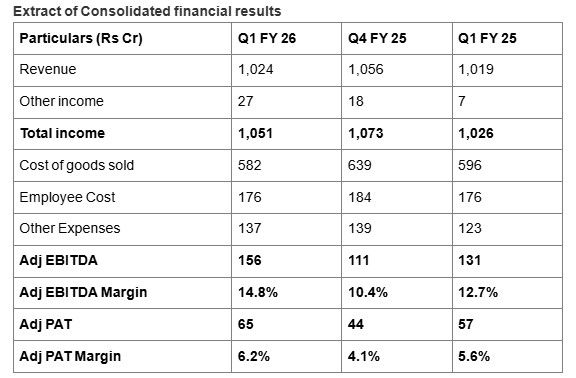

In Q1 FY26, Akums reported total income of Rs. 1,051 crore, with healthy Adj EBITDA of Rs. 156 crore reflecting a robust 19.1% year-on-year (YoY) growth. The margins improved to 14.8% from 12.7% last year a 208 bps improvement.

During this quarter, the company achieved a key milestone of reaching 1,000 Drug Controller General of India (DCGI) approvals, with 27 fresh approvals in this quarter. The DCGI approvals assist the company in enhancing its product mix, building a differentiated and research-driven portfolio. Additionally, the company also received a patent for its extended-release combination formulation of Doxylamine and Pyridoxine developed using the company's tablet in tablet technology.

As part of Akums' strategic vision to establish itself as a leading global CDMO, the company received its first EU dossier approval for Rivaroxaban. It also filed its first dossier of Dapagliflozin combination in Switzerland. Both of these new products hold significant market potential. The commercialization of the EU contract also continues to be on track and the company will commence commercial supplies from April 2027.

Akums received 100 mn Euros as part consideration for the EU contract in Q1 this year, consequently the company is at a cash surplus of Rs. 1,518 cr. The strong liquidity position provides a robust foundation for Akums to strategically scale up its business operations through both organic growth initiatives and inorganic opportunities.

Segmental Performance Overview

Akums' flagship business, CDMO, contributed ~79% to the group turnover with an EBITDA of 14.7% in Q1 FY 26. The company's domestic branded formulation business segment reported ~3% YoY growth while international branded formulation business grew by ~2% YoY. Trade generics and API segment continue to be in operational loss this quarter, though, through the management efforts, the losses are gradually reducing.

Commenting on the results, Mr. Sanjeev Jain, Managing Director, said, "This date marks just over one year since we got listed. We continue to work towards strengthening the organization with a focus on long term growth. Our commitment to becoming a global CDMO player remains steadfast. The recent filings along with the planned global approvals of other facilities are setting up us in that endeavor."

Mr. Sandeep Jain, Managing Director, added, "We continue to deliver strong performance despite the industry headwinds of decreasing API prices and muted volume growth. With a sustained focus on R&D, we have been able to deliver robust growth. Achieving 1,000 DCGI approvals is a key milestone that stands out Akums from its peers, allowing Akums to offer margin accretive differentiated offerings. We remain focused on strengthening our CDMO leadership, scaling high-value capabilities, and driving operational excellence. Backed by a strong pipeline and prudent capital allocation, we are well-positioned to deliver sustainable and profitable growth in the years ahead."

Definitions

- Adjusted EBITDA has been calculated as the sum of profit/ (loss) for the quarter, tax expenses, finance costs, depreciation and amortization expense, fair value changes to financial instruments, and exceptional items.

- Adjusted PAT is calculated as the profit for the quarter plus fair value changes to financial instruments less tax deferred tax created on brought forward losses.

- CDMO: Contract Development and Manufacturing Operations

- API: Active Pharmaceutical Ingredients

(ADVERTORIAL DISCLAIMER: The above press release has been provided by NewsVoir. ANI will not be responsible in any way for the content of the same)